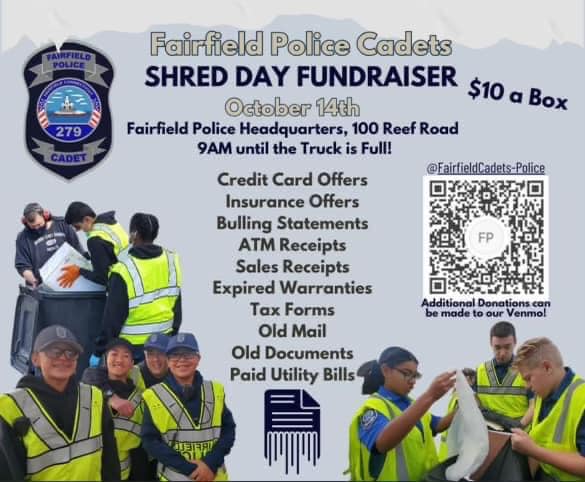

SHRED DAY – Proceeds benefit Fairfield Police Cadet Post 279!

Wondering What to Shred?

Bank statements. Experts across the board agree: bank statements should be shredded. As soon as you get the information you need from your statement, shred the document immediately; failing to ensures criminals have access to personal information.

Pay stubs. Though perhaps not thought of as dangerous documents, pay stubs contain more personal information than you might think. Shredding old pay stubs keeps identity thieves from knowing your health care providers and where you bank.

Junk mail. Left un-shredded, an identity thief could easily fill out a pre-approved credit card application on your behalf.

Old tax returns. You should save tax returns for at least three years, but remember incorrectly filing your taxes can lead to IRS audits further down the road. Tax returns contain a wealth of personal information and should be safely disposed of.

Medical records. Even though you should keep a personal copy of your medical records, remember to shred it when you feel that the information is no longer needed. Keep any medical bills for about a year after they’re paid, then throw them into the shredder.

Insurance records. Insurance records are another document you need to hold onto longer than other documents. Hold onto them for as long as your policy is active, plus about five years, then shred them — they’re another potential jackpot for identity thieves.

Credit card statements. Being a smart credit card user requires effort. Transitioning to online statements is a great way to protect yourself from physical document identity theft, but if you do still get paper statements, make sure to shred them.

Old passports and photo IDs. If you hold onto your old passports and photo IDs after they expire, shred them the minute you don’t need them. An identity thief with either is incredibly dangerous. Also remember to be extremely careful with passports while they’re still in use.

Family photos. Consider shredding old photos instead of just throwing them out (after you’ve digitized them, of course). Thieves can use your photos maliciously, and even if they can’t steal your identity using old images, it’s still a good idea to keep them secure.

Monthly Bills. Bills can contain your full name, address, account details and even your signature. This information is harmful in the hands of thieves.

Expired Or Cancelled Credit Cards. Sometimes renewed credit cards have the same account number as the expired or cancelled card. The only difference between the two cards is the expiration date. This makes stealing your new account easy. Even cancelled credit card accounts provide a way for thieves to gain access to your new account, or to open a new account under your name.

Documents that have:

- Social Security Numbers!

- account numbers

- passwords

- signatures

**Your Social Security Number

Your social security number is as good as gold to identity thieves. This is why you should destroy any unnecessary documents containing your social security number.

What if you notice that there’s a persistent source of documents containing it? In that case, it’s worthwhile to ask the provider if they can withhold your social security number from printed forms as an extra precaution.

Location:

Behind Police Headquarters

100 Reef Road, Fairfield Ct